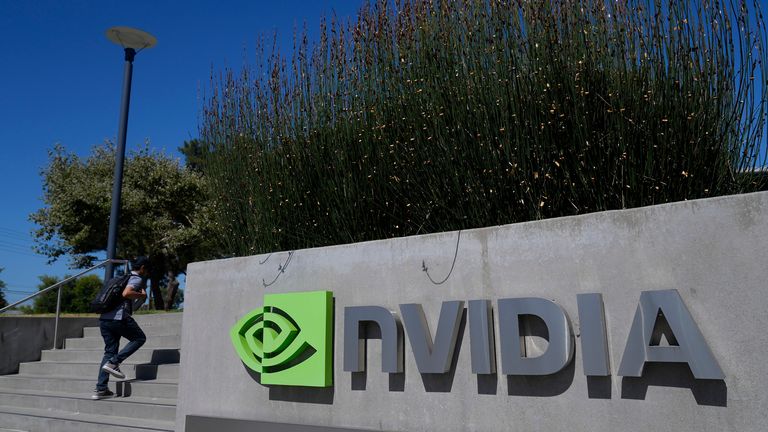

US tech stocks are falling despite Nvidia, the chipmaker driving the artificial intelligence (AI) led stock market boom, reporting stronger than expected earnings.

The company, which has been the darling of US markets with shares up 150% this year alone, reported second quarter revenue of just over $30bn – more than double the sum achieved in the same period a year ago.

Nvidia‘s crucial forecast for sales in the current quarter, $32.5bn, also beat estimates but only slightly.

Money latest: Capital gains tax hike on the way, leading advisory firm says

That may have been the catalyst for its shares suffering a rare decline in value following an earnings update.

A fall of up to 6.8% was recorded in after-hours dealing, according to the Reuters news agency.

That built on losses of more than 2% during Wednesday’s main trading hours.

Some major customers, including Meta and Amazon, were also hit but the red figures were around the 1% mark for both.

The fortunes of Nvidia, which holds 80% of the AI chip market, are being closely watched for signals that the big investment opportunity that is AI remains on a solid upward curve.

Confidence wobbled at the start of August when US data raised fears of a recession, sparking a short-lived but sharp global stock sell-off that sent investors towards safe-haven government bonds.

For Nvidia a recession, while seen as very unlikely, would be a risk to demand for AI and, therefore, its products.

Its prospects and success to date has earned it a lofty market value of $3.2trn, according to LSEG data.

The shares are 3,000% up since 2019.

But the meteoric rise, that has left Nvidia just behind Apple in terms of market value, has raised fears of a repeat of the dot-com bubble bursting two decades ago.

Tech stocks have outperformed the market and are seen as vulnerable to shocks on a value versus earnings basis.

Worries over a design-led delay in the launch of Nvidia’s upcoming Blackwell chips have contributed to recent price wobbles, though the shares have largely held up as its existing Hopper chips were seen as filling any short-term void.

Nvidia said on Wednesday it had already shipped Blackwell pilots to customers and partners. It expected sales to ramp up from the end of the year.

Traders in the US equity options market had expected the earnings report to spark a more than $300bn swing in the shares in advance of the release being made public.

But analysts said that the share price declines seen instead may reflect jitters on the value question.

Matt Britzman, senior equity analyst at Hargreaves Lansdown, said of the update: “Nvidia continues to defy gravity with its seventh straight quarter beating expectations on both the top and bottom line, showing a masterful delivery of performance and guidance from Jensen Huang and the Nvidia team.

“But early trading suggests that’s not enough to keep the market happy. It’s less about just beating estimates now, markets expect them to be shattered and it’s the scale of the beat today that looks to have disappointed a touch.”